Is the Udacity AI for Trading Nanodegree Any Good?

30% discount on Udacity subscriptions with code SECONDCHANCE until December 18th

Introduction

Hi, and welcome to my Review of the Udacity Artificial Intelligence for Trading Nanodegree.

Background

Anyone interested in machine learning and artificial intelligence has, at some point, wanted to develop algorithms for trading stocks. It’s an entire industry where companies invest billions in outsmarting the competition.

My experience

Even though I have years of experience as a machine learning engineer using traditional methods and deep learning algorithms, I didn’t know much about stocks. But when I saw that Udacity offered a course on AI for trading, I decided to try it out.

Table of contents

Summary

Here’s a quick summary in case you run a tight schedule.

Curriculum (5/5)

I loved that the curriculum focused on a foundational understanding of quant best practices rather than flashy algorithms. It’s intriguing to jump straight into that last part, but you would make thousands of mistakes that have professional traders rolling on the floor laughing.

Projects & Exercises (4/5)

The projects and exercises are good and test your knowledge of previous lessons, but they contain too much boilerplate for my taste. I learn more by building from scratch.

Transfers to work (5/5)

Thanks to all the lessons on stocks and traditional analysis, you become well-prepared for a job in financial modeling. However, it’s not a substitute for hands-on practice.

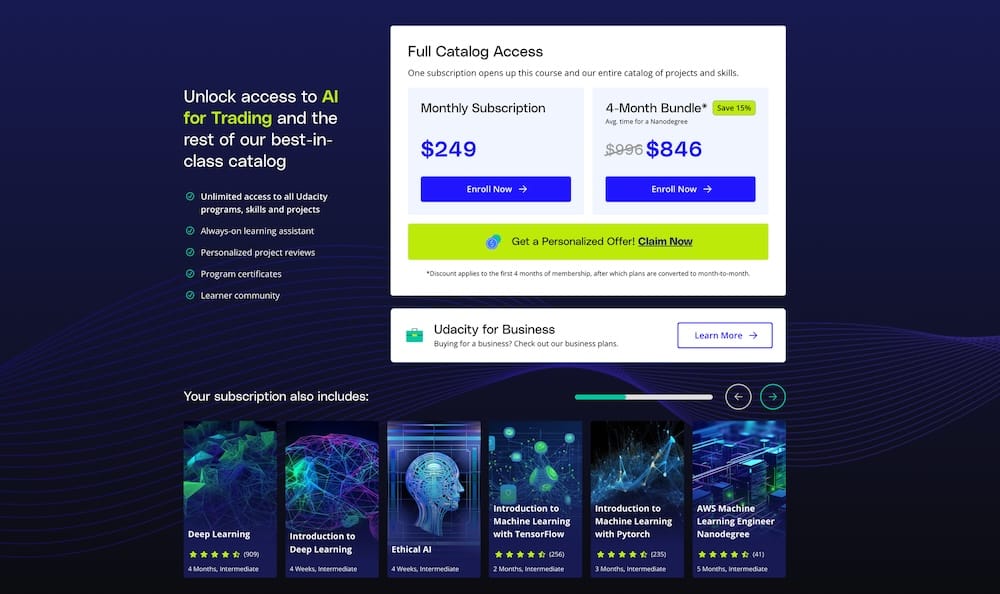

Affordable (3/5)

You can learn the same things for less money but get access to high-quality content for your investment. It’s one of the best courses on AI for trading if you’re a visual learner and if your finances can handle the price.

Overall (4.5/5)

If you want to start developing algorithms for trading stock but don’t have much previous financial data experience, Udacity’s Artificial Intelligence for Trading Nanodegree is a perfect alternative. You’ll learn a mix between traditional methods and more advanced machine learning approaches, including natural language processing.

I’m delighted with the course because it prioritized my weak areas and helped me build a solid foundation. I’ve done a few experiments since and avoided many pitfalls because of what I learned.

Full Review of The AI for Trading Nanodegree

I was surprised about the amount of content related to quantitative analysis. This program aims to produce quants who make the most of machine learning.

Understanding how quants think before turning to AI is the right strategy. Otherwise, you’ll likely step into well-known traps that can cost you a lot of money.

Course 1: Basic quantitative trading

Working with financial data and stock prices is complex, with hundreds of costly pitfalls. You are trying to predict the future, and that’s almost impossible by definition.

This Nanodegree is heavy on theory because if you don’t know common pitfalls, you’re heading for failure. And failing with your stock-picking algorithms is expensive.

Understanding market fundamentals

Naturally, the place to start is at the very beginning. Therefore, you’ll begin by learning about stocks in general and market mechanics.

Many of you probably know everything about this already, but it was undoubtedly helpful for me. I did have a slight interest in trading before the course, but I needed to refresh the basics.

Introducing alpha signals

Next, you are introduced to alpha signals, the building blocks of trading strategies. Alpha signals can be anything that might give information about a stock’s future price.

You’ll learn to calculate stock returns and implement one of the most common alpha signals.

Your first project

In the project for this first section of the artificial intelligence for trading Nanodegree, your task is to create a trading strategy using momentum.

People who want to start building machine learning algorithms for trading stocks might become demotivated by the first sections of this Nanodegree.

I didn’t appreciate them at first, but once I graduated, these parts gave me the most.

Part 2: Advanced quantitative trading

After you finish the first part of the artificial intelligence for trading Nanodegree, you’ll step into the shoes of a quant. People are working with trading strategies without using machine learning as well. It’s essential to understand what they already do.

Quant workflow and best practices

I enjoyed learning about the quant workflow. There’s a lot at stake, so you need to be careful. It’s clear that the goal is steady returns rather than hitting that one home run.

The lessons about outliers are also helpful because this is certainly something that many beginners miss. Of course, when you start working with machine learning algorithms, you can make them resistant to outliers in other ways.

Traditional analysis

Machine learning is cool, but there are many purely statistical tools you should master as well. The most common one is regression, but since it’s sensitive, you also learn about data pre-processing.

In the time series lesson, you’ll learn about more advanced methods, and they even introduce neural networks. I found the traditional methods more interesting, probably because I’ve worked with neural networks for several years.

Volatility & Pairs trading

Volatility is another essential concept when analyzing stocks. High volatility means high risk but also high reward.

These things are fundamental for people working with financial data, so make sure to master the content.

Create a breakout strategy

The goal of the second project is to create a breakout strategy. You’ll base the strategy on some of the things you learned in the previous lessons, and your goal is profitability.

I enjoyed this project because it immediately becomes more interesting when we start simulating money.

Part 3: Stocks, Indices, and ETFs

There are more things to trade than stocks. In this section, you’ll learn about some other common alternatives. These lessons also help you to understand how other stakeholders work with their portfolios.

When you create portfolios, you want to score them and optimize them according to some metrics. It’s an interesting section, and much of the information was new to me.

Naturally, the project is to start optimizing your portfolio based on the new techniques you now know. Optimization is surprisingly similar to machine learning. The biggest difference is that you don’t work with validation in the same way.

I really liked learning about beta optimization. At this stage in the artificial intelligence for trading Nanodegree, most of the content was new to me. It’s always fun to read about something that you know very little about because it feels like a new world.

Part 4: Factor investing and alpha research

This is the only part that has changed a bit since I completed the course. It now contains four lessons instead of seven, and they have slightly different names.

Factors & Risk factors

The first two lessons of the sections are now combined into one lesson called factor models for returns. Factor investing is another type of investment strategy where you’re trying to find stocks with a low price compared to their fundamental value.

Next, up you’ll learn how to model risk using factors. These lessons are also combined into one new course called Risk Factor Models. I’m not sure if it contains the same videos, but the majority is probably the same.

I really enjoyed learning about factor investing because the ideas were new to me. I know that it’s a well-established field, but I don’t know many people in finance.

Alpha factors

Alpha describes your trading strategy’s ability to beat the market. It’s the difference between the stock returns and the factors contributing to the returns. I struggled a bit to get my head around some of these concepts, and I’m not sure if I succeeded.

The project in part 4 changed its name to “Advanced Portfolio Optimization with Risk and Alpha Factors Models”.

This was the part of the AI for trading Nanodegree that I enjoyed most so far. You learn how real investors work with managing risk, and it’s certainly interesting.

Part 5: Sentiment analysis with natural language processing

Part 5 is where you’ll start looking at machine learning algorithms. In this Nanodegree, they’re mostly used as a way to extract alpha factors that you can use when you optimize your portfolio.

Natural language processing

Natural language processing is a field within computer science where we want computers to understand language. Because of innovations within deep learning, machine learning has completely taken over NLP in recent years.

However, these lessons are more about preparing for natural language processing by using regex and other methods to extract features from the text.

Writing rules for extracting text is not one of my favorite things to do in the world. I have plenty of bad experiences developing software for workflows involving PDF files.

Extracting information from financial statements

The section continues with even more feature extraction from text. Here, you’ll learn useful tools such as BeautifulSoup to get information from the internet and parse the HTML response for valuable information.

In the project, you will implement some basic analysis of the financial statements. Some people might call this AI, but I wouldn’t. It’s mostly creating similarity metrics that you can use as input later.

It’s probably a decent exercise, but I’m just not a fan of working with text. Luckily for the students, the next section focuses on natural language processing using deep learning.

Part 6: Advanced Natural Language

Processing with Deep Learning

Now we are on my turf. Deep learning is where I’ve spent most of my time for the past five years. My company does some NLP, but we work more with image, video, and audio.

Part 6 starts with some background on neural networks. If you’ve participated in some other Udacity Nanodegrees before, you probably already know most of this.

Next, you’ll learn about recurrent neural networks and word embeddings. Most people don’t use RNNs for text analysis anymore, but it works well for many more straightforward tasks.

Both parts are good, but it’s clear that the main focus of Udacity artificial intelligence for trading nanodegree is the quantitative aspect.

Neural network project

In the project, you’ll develop an algorithm for sentiment analysis. It’s a common use case where you want to know the underlying sentiment of a text. It can be helpful if you want to include news about companies in your trading strategy.

This is the only part of the Nanodegree that includes deep learning. I must say that I was a little bit disappointed that the course didn’t include more advanced AI for trading, such as reinforcement learning.

FYI: There’s an optional section about building deep reinforcement learning algorithms for trading stocks in the Deep Reinforcement Learning Nanodegree.

Part 7: Combining multiple signals

In this part, you’ll learn more about some traditional machine learning algorithms, such as decision trees, to combine the factors you studied previously. You also learn how to create features for your algorithms and analyze the patterns it detects.

I won’t go into much detail here. The lessons basically cover machine learning fundamentals and how to work with features.

Random forest project

In the project, you’ll implement a random forest algorithm for improving your alpha.

It’s good that they added a section with machine learning where it’s actually related to trading. Otherwise, they could have called the course quant analysis or something along those lines.

I think it’s a bit strange to call the course AI for trading. These machine learning methods are very similar to statistical models and not what most people think about when they hear artificial intelligence.

Part 8: Simulating trades with historical data

This last part is where it all (apart from the NLP) comes together. Once you start simulating your trading strategies, everything becomes a lot more fun. Many beginners make mistakes in their simulation by adding information that wasn’t available at the time, so pay close attention.

When you have good backtesting in place, you can quickly test and compare different trading strategies. It’s a critical exercise that you need to master if you’re serious about building AI algorithms for trading.

I really enjoyed this section because it covers such a vital aspect of trading. It was also a perfect finish to a great Nanodegree, where I learned so much about analyzing stock data that I didn’t know before.

Pros & Cons

That was a long walkthrough and review of the content in the Udacity AI for trading nanodegree. Now, let’s take a closer look at the pros and cons and decide if this online program is worth the investment.

Things I Loved About this Nanodegree

Let’s start with the positives.

Thorough content about real analysis

Everybody wants to create advanced machine-learning algorithms that can beat the stock market and make millions. I really like that Udacity stays sober and focuses on teaching students how it actually works.

It would be easy to take advantage of the hype around artificial intelligence and teach things that look cool but don’t work. Of course, that would jeopardize the Udacity brand.

For someone like me, with little experience in trading stocks, the thorough explanation of all the concepts that quants take for granted was so valuable.

Beautiful videos and illustrations

This is what I would call Udacity’s primary differentiator. They put a lot of effort into making their content visually appealing. Some people don’t care about that, but to me, it’s crucial for effective learning.

Getting students ready for real work

Udacity’s brand centers around teaching skills that companies want, which is what they do in this Nanodegree. The goal is to give you the knowledge you need to manage a junior position.

Things I didn’t like as much

And a few negatives.

No reinforcement learning

The biggest downside was that there wasn’t a section about developing reinforcement learning algorithms for trading. I wanted to see something where we use machine learning directly on the stock data, not just alpha signals.

I understand it’s a bit risky to create complex models for trading stock, but it would be a fun addition to all the content about more sober analysis.

Why all the NLP?

I get that NLP is an exciting topic for predicting stock prices, especially in the short term. If you have an algorithm that monitors press releases, you can automatically understand its contents and take action. That would allow you to sell stocks a millisecond after some bad news, which could save you millions of dollars in some cases.

That said, I don’t feel the natural language processing section was necessary for the artificial intelligence for trading Nanodegree. That includes the section about deep learning and the one before about extracting features from financial statements.

Udacity should replace these two sections with something related to reinforcement learning for trading. Maybe they believe it’s too large a subject, but I think they can do it in one or two sections.

Is the AI for Trading Nanodegree Worth the Money?

If the course is worth the price depends on your learning style and financial situation. If 249$ a month is something you can live without, this is an excellent online course for anyone wanting to learn more about AI for trading stocks, especially if you're a visual learner who enjoys high-quality videos.

You can learn everything for free these days, even complete university programs, so the question is if a program like this one would speed up the process. If the price point has a clear negative impact on your quality of life, there are cheaper alternatives.

For me, it helps to invest some money when I want to learn a new subject because it forces me to finish. I also believe that Udacity currently has the best content and that the prices are reasonable.

Personal discounts

It's possible to get a discount on your first month of learning. So, if you're price sensitive, clear your calendar, grab the discount and finish the course in a month. It's 100% possible.

Udacity has also changed its pricing model, and you now get access to all their paid course when you enroll in the AI for trading Nanodegree.

Also, when you finish the AI for trading Nanodegree, you continue to have access to the content when you cancel your subscription.

Who should study this nanodegree?

The person who would get the most out of this course is more interested in trading stocks than in AI and machine learning. Also, it’s helpful if you have some experience with programming.

Another ideally suited student is someone like me, who already knows programming and algorithms but has little experience with stocks.

If you’re more interested in developing automated trading algorithms that learn over time, you might be more interested in the deep reinforcement learning nanodegree.

Final Thoughts

In this Udacity AI for Trading Nanodegree review, I’ve told you what I learned, liked, and didn’t like. The course is heavy on trading theory, which is great but maybe not that fun for people who want to develop algorithms.

In any case, I can recommend this Nanodegree. I enjoyed it a lot, and much of the content was new to me. The title “AI for trading” is a bit misconceiving, but if trading is what you want to learn, go ahead and check out the Artificial Intelligence for Trading Nanodegree.